The Green Mortgage

The Green Mortgage

1. Introduction

Note: This is a living document. I’m still actively adding sources, updating text, and creating figures and animations.

In this series, I’d like to shamelessly promote an idea I have stolen (as far as I can trace it) from Saul Griffith: the Green Mortgage.

Griffith credits much of our modern world to credit (the financial kind). The car loan (invented in the 1920s) and the 25-year mortgage (1940s) lifted a large chunk of Americans into the middle class and ignited the conflagration known as modern finance (for good or bad).

In the 2020s, he argues, we need a climate loan. The most environmentally impactful decisions on the individual level are irregular, once-a-decade decisions—things like putting solar on the roof, electric cars in the garage, energy efficient washers and dryers in the house, an electric heat pump in the basement, etc. We need new financing instruments to make it easier to make the right choice when these decisions come our way.

At these crossroad moments, our primary imperative is to electrify. Even if our electricity comes from fossil fuels, large power plants are typically more efficient than small car engines and residential furnaces. Electrifying sets us up to fully abandon fossil fuels in the future. A green mortgage is primarily an electrification mortgage

In this series, I would like to explore what a green mortgage actually looks like at different income levels and housing/family situations, what to include in the package, and how much it will cost. It’s to rank different interventions by emissions saved and address complications like “when is the optimal time to replace a still-functioning gas-powered car with an electric one?”

Best of all, I’m using [[0 Inbox/InteractiveJS|a new tool I’ve designed]] to make more interactive documents. This will let you play around with the parameters to see, for example, how the conclusions change as the grid becomes cleaner, or to see what the green mortgage might look like for your own home.

Start with the Rich

The rich are disproportionately responsible for climate change. This is true for countries as well as for individuals. For example, the rich tend to live in single-family detached homes, which account for 60% of all housing units (in 2000) [@bennefield2003] but three quarters of total residential energy use [@otherlab-sankey]. They drive further to work, own more (and larger) cars, take regular flights, maintain more lifeless, larger lawns1, and so on.

So if we’re talking about getting the most bang for our buck, we have to start by rehabilitating the rich. It also make sense because they have more money to put towards initiatives like these. It’s the Tesla approach of building uberexpensive Roadster’s before “more affordable” Model S’s before almost affordable Model 3’s.

First though, I need to make an important point—one that the wealthy are not particularly keen to hear. Before anything else (i.e., before electrification), we need to decrease our consumption. Even if we fully electrify and convert to 100% renewable resources, it is impossible to scale the American dream of McMansions, ATVs, and 24/7 steaks to every person without guaranteeing the demise of the natural world.2

Which we don’t want.

So if you currently occupy one of these 350+ square meter behemoths (3800+ square feet), stop being an entitled asshole, and begin by downsizing.3 That also means you, Bill4.

With this caveat, let us sketch what the green mortgage might look like for a lower upperclass US household (top 80%-95% of household incomes). This is a household with an income of roughly $100,000—300,000 a year (still falls into the “lower” category because wealth is so unbelievably unevenly distributed at the upper end[^5]).

[^5] The 96th to 99th percentiles take about twice as much in annual income as the average over the 80th to 95th percentiles, the top one percent takes four times as much as that, the top 0.01 percent takes 20 times on top of those multipliers, and so on.

2. The Financial Costs

We begin by computing the one-time installation costs of a full green renewal—electrifying everything that we could conceivably electrify. Later on, we can look at whether each of these interventions actually makes environmental sense, how quickly the investments pay for themselves, and how best to schedule the electrification.

For the sake of example, we will work with a hypothetical family of =family.size living in a =home.area, =home.num_rooms:"%i{-room}" home (valued at =home.value) with =cars.num—the “Andersons”.

// Familyfamily.size: `%n {people}` = NUMBER(1, 10) ?? 4

// Homehome.area: "%i m2" = NUMBER(0, 500, 10) ?? 250home.value_per_m2: `$%i/m2 ` = NUMBER(10, 1000, 10) ?? 500home.m2_per_room: `%i m2{/room}` = NUMBER(5, 50, 5) ?? 20home.num_rooms: {one: `%n {room}`, other: `%n {rooms}`} = home.area / home.m2_per_roomhome.value: "$%i," = home.area * home.value_per_m2

// Carscars.num: "%n {cars}" = NUMBER(0, 5) ?? 2Note 1: We’ll be ignoring tax-incentives and other programs that effectively lower the price.

Note 2: See the values in green? These are our first interactive elements. Try clicking on them and dragging left or right. As a result, you’ll see the values in blue start to change.

🌞 The Roof (=solar.cost)

First up on our list of interventions is the roof.

=solar.area:"{Estimating we have} %i m2 {of roof available for solar}", we can manage up to a =solar.kw system (=solar.kw_multiple the =solar.kw_avg_resid: "{size of the average residential installation}"). At =solar.cost_per_kw This will probably cost =solar.cost to install (I invite you to play around with Google’s Project Sunroof). At a conversion factor of solar.kwh_per_day_per_kw (which depends on altitude, cloudiness, shade from trees, etc.), this installation provides the Andersons an average of solar.kwh_per_day.

home.num_stories: "%i {average stories}" = NUMBER(0.5, 5, .5) ?? 2

roof.slant: "%i deg" = NUMBER(0, 75) ?? 30roof.area: "%i m2" = home.area/home.num_stories/COS(roof.slant)roof.available: "%p%" = NUMBER(0, 1, .01) ?? .8

solar.area: "%i m2" = roof.area * roof.availablesolar.kw_per_m2: "%f.2 kW/m2" = NUMBER(0, 1, .01) ?? .15solar.kw: "%i kW/" = FLOOR(solar.area * solar.kw_per_m2)

solar.kw_avg_resid = 6solar.kw_multiple: "%ix" = solar.kw / solar.kw_avg_residentialsolar.kw_multiple.md = "[@fu2016]"

solar.cost_per_kw: "$%d,/kW" = NUMBER(0, 3000, 100) ?? 1500solar.cost: "$%d," = solar.kw * solar.cost_per_kw

solar.kwh_per_day_per_kw: "%f.2 kWh {actual}/d/(kW {capacity})" = NUMBER(0, 10, 0.1) ?? 3.5solar.kwh_per_day: "%d kWh/d" = solar.kw * solar.kwh_per_day_per_kw🚗 The Cars ($90,000)

Our family goes for an extended range Tesla Model 3 at $50,000. And they get a Chevy Bolt for $35,000. Together with two level two charging stations (~$5,000), electrifying the Anderson transportation fleet will cost around $90,000.

🔋 The Battery ($20,000)

A fair number of American home-owners already experiences regular power outages. In my childhood home in New York State, I remember (with something nearing fondness) 2011’s hurricane Sandy knocking us out of power for nine days.

Climate change is going to increase the frequency and intensity of extreme weather, thus also the likelihood of regular grid outgage, so—if only for adaptation purposes—the Andersons need some batteries.

Tesla recommends one Powerwall for every 7.6 kW AC of solar installed, so our family gets two Powerwalls. That’s $15,000 for the batteries themselves, $1,000 for a coupling device called a “Gateway” and $3,000 for installation costs. Let’s round up and call it an even $20,000.

Between these two batteries, the family gets 27 kWh of storage capacity in addition to the capacity of the cars. That’s 82 kWh for the extended range Model 3, and 65kWh for the Chevy Bolt. So, in total, the family has up to 175 kWh of storage available.

Depending on how much electricity they need for heating, whether their solar panels are obscured by a layer of snow or not, and how much they need to drive, our family should be able to outlast most storms. In order to make that statement just a little more precise, we turn to heating next.

🧦 Insulation ($45,000—60,000)

The Andersons live in an older house, so before going crazy with electric heating, they stand much to gain from investing in humble insulation (they are far enough enough North for cold winters).

- 🪟Windows: The Andersons have between 30 and 40 square meters of glass across 50 windows1. For the sake of example, suppose all windows are single pane, and we want to upgrade everything (rather than retrofitting existing windows with an add-on glaze). The Andersons end up going for double pane rather than triple pane windows at an average cost of $750 per window, which comes to a total of $37,500. Windows are not cheap, especially on older homes.

- 🧱 Walls: Fortunately, the Andersons’ home has cavity walls, which are easier to retroactively insulate than solid walls. They go with a polyurethane foam option, which costs around $25 per square meter. With somewhere between 300 and 500 square meters of walls, of which not everything is insulable, the total comes in somewhere between $5,000 and $10,000.

- 🛖 Loft: With easy access to the loft, the Andersons go for a fiberglass insulating option at a very comparable price to the foam (~$25 per square meter). The price for this, using the roof area we computed for the solar panels, are somewhere between $3,750 and $5,000

- 🪵 Suspended floor: Another lucky strike for the Andersons: their floors are easily accessible from underneath via the basement. That means inserting new insulation isn’t going to require them to tear up the floor boards. Still, it doesn’t come free, 125 square meters of floor boards come to roughly $3,000 in insulation.

🌡 Heating and Cooling ($50,000)

The most straightforward electric heating solution is the heat pump, a device that transfers heat between your house and an external heat reservoir much as a fridge does. Perhaps the best feature of a heat pump is that it can pump in both directions, so it solves both heating and cooling.

Most common is the air-source heat pump, in which the reservoir is the air outside your home. But the Andersons decide to go further. They opt in for a ground-based system where the reservoir is a fluid—some kind of antifreeze—that is pumped underground (by a separate circulation pump). The more constant temperature below ground means the heat pump can work more efficiently.

The Andersons go for the larger five-ton heat pump, which by itself—at around $2,500 per ton—has a price tag of $12,500. The costs of digging a vertical closed loop system have a roughly equal price tag.

But then there’s the fact that the Anderson’s live in an older house that previously got its heating via radiators. Their geothermal system is air-to-fluid, which means they will need to install ductwork throughout their house. All in all, this retrofitting costs another $20,000.

Let’s round up again (to account for things like a new smart thermometer, unforeseen installation costs, etc.), and we estimate the total costs at around $50,000.

It still requires some electricity to run the fan that circulates the hot air and to keep the circulation pump going, but the Andersons have almost fully relinquished their direct dependence on oil.

🍃 Lawn ($500—5,000)

To fully rid the Andersons of their addiction to oil, we have to take a look in their garage and outside their house. The gas-powered lawn-mower, weed-wacker, chainsaw, and leaf-blower all have to go.

Now, you could electrify all these for less than $500 (as long as you choose a smaller lawn-mower). But that would spare the Anderson’s an important learning opportunity.

Occupying 40 million acres of land in the continental US, lawns are America’s number one crop. They’re also incredibly water-, pesticide-, and time-intensive, utterly devoid of biodiversity, and let’s admit it, sterile and pathetic-looking. The Andersons’ lawn has to go.

That’s going to be difficult for Mr. Anderson who has grown up equating lawns with success. It might be years and many sessions of psychotherapy before he shakes this more insidious, personally involving addiction, before he can suppress the urge to go blasting his leaf blower at six in the morning on a Sunday. But he has to give it up—the natural world can no longer maintain the terror of lawns.

Enough of my rant, what all this means practically is that the Green Mortgage is an opportunity for landowners to “rewild” their lawns. One-time services run upwards of $5,000, not including recurring landscaping work thereafter. Fortunately, nature-friendly landscaping tends to be less labor-intensive than conventional lawns once up and running. Since the Anderson’s are already spending ridiculous amounts on landscaping crews to come by weekly, they stand to save money relatively quickly.

🍳 Appliances ($3,000—8,000)

After oil and lawns, next to go is the Anderson’s dependency on propane, which they still use for their stove and hot water.

Water Heater ($2,000) Let’s start with water. Their heat pump already gets them part of the way there—the Andersons opted for a small add-on module that preheats water before it enters the boiler, but to go 100%, they need to transition to electric.

In fact, since they no longer need a boiler to heat their radiators, they can downsize to a 50 gallon electric water heater. With installation fees, this ends up costing the Anderson’s $2,000.

The Oven ($1,000—4,000) After getting an energy-efficient electric oven for just over $1,000, the Andersons have officially cut out their direct consumption of fossil fuels. They feel pretty good about it.

Well, there is one thing left—the grill. For an avid grillmaster like Mr. Anderson, this is probably the single most controversial item on the list. How is he to make his delicious burgers without his beloved propane grill?2 Tough luck man. You can either shell out another $1,000—3,000 or abandon the grill altogether.

Thus, we have gotten through all the changes essential to electrification. Depending on how old their other large appliances are, the Andersons might consider getting a more efficient model. According to the EPA, average annual energy for these appliances are (in decreasing order):

- The Dryer (769 kWh/year)

- The Fridge (596 kWh/year)

- The Washing Machine (590 kWh/year)

- The Dishwasher (206 kWh/year)

The most efficient modern models are, in most cases, radically better:

- The Dryer (125 kWh/year)

- The Fridge (186 kWh/year)

- The Washing Machine (120 kWh/year)

- The Dishwasher (196 kWh/year)

Replacing the entire set with the best new models, all in all, would not put the Andersons back more than $5,000, thereby completing the transformation.3

Total Costs ($233,000—260,000)

Let’s tally up the costs in order of decreasing costs:

- $90,000 (Cars)

- $45,000—60,000 (Insulation)

- $50,000 (Geothermal)

- $20,000—25,000 (Solar Roof)

- $20,000 (Batteries)

- $5,000 (Lawn)

- $3,000—12,000 (Appliances)

For a total of $233,000—260,000, about a quarter of the home’s value. For the rest of the series, we will work with $250,000 as the baseline.

Amortizement ($900—1,900/month)

With a 30 year amortizement period, $50,000 down payment, and the standard 3.2% APR for home mortgages, the green mortgage, on its own, would add $110,000 in interest at a monthly price of $900. A shorter 15-year mortgage at an interest rate of 2.43% would add only $40,000 in interest fees for a total of about $1,300 a month. Finally, a 10-year mortgage at 2.38% APR would cost $25,000 in interest at almost $1,900 a month.

Property Tax and Insurance ($500/month)

If you add $250,000 in renovations to your house, your home value will increase, and, with it, the amount you spend on property taxes. How much will depend entirely on where you live—annual property taxes range from the permils (0.1%) to almost 3%.

Again, our example concerns a lower upper class family, so we assume they live in a county that takes towards the higher end—let’s say 2%. We add $5,000 to the annual cost (a bit over $400 a month).

Lastly, the Andersons, responsible home owners as they are, need to insure the new goods. An increase in home value of $250,000 means something like a $75 increase in monthly payments or $900 a year. That said, some of these improvements, such as better insulation, might decrease premiums.

Conclusion

With a longer duration 30-year mortgage, the Andersons are looking at a price tag of aboout $1,400 a month. With the shorter 10-year mortage, this jumps up to $2,400 a month. (With $500/month persisting even after the mortgages are paid off).

But really, this is not the right way to make this calculation, because in most cases the Anderson’s almost immediately save on their monthly bills. So in the next chapter, we’ll factor in these savings to compute the actual “effective” monthly cost.

3. The Financial Payback

In the last instalment in this series, we determined that a complete electric overhaul—solar roof, batteries, electric vehicles, geothermal, better insulation, etc.—will cost the average lower upper-class family (the “Andersons”) between $200-250,000 up front. After amortizement, property taxes, and insurance, they’re looking at a monthly fee of $1,400 (30-year mortgage) to $2,400 (10-year mortgage).

But really that figure is misleading: almost all of the changes included in the green mortgage immediately lower the Andersons’ monthly utility bills. What really matters is the net change in monthly costs. In this installment we’ll compute how much the Andersons save and, in turn, the effective monthly cost of their green mortgage.

Preliminaries

Most of these calculations depend wholly on how much the Andersons were paying for electricity, gas, oil, and propane before electrification.

Let’s fix these prices beforehand. For consistency, we assume we’re somewhere in the NY metropolitan area.

- Electricity: 19¢/kWh

- Gasoline: $3.26/gallon

- Heating Oil: $3.50/gallon

- Propane: $3.42/gallon

🌞 The Roof (+$300/month)

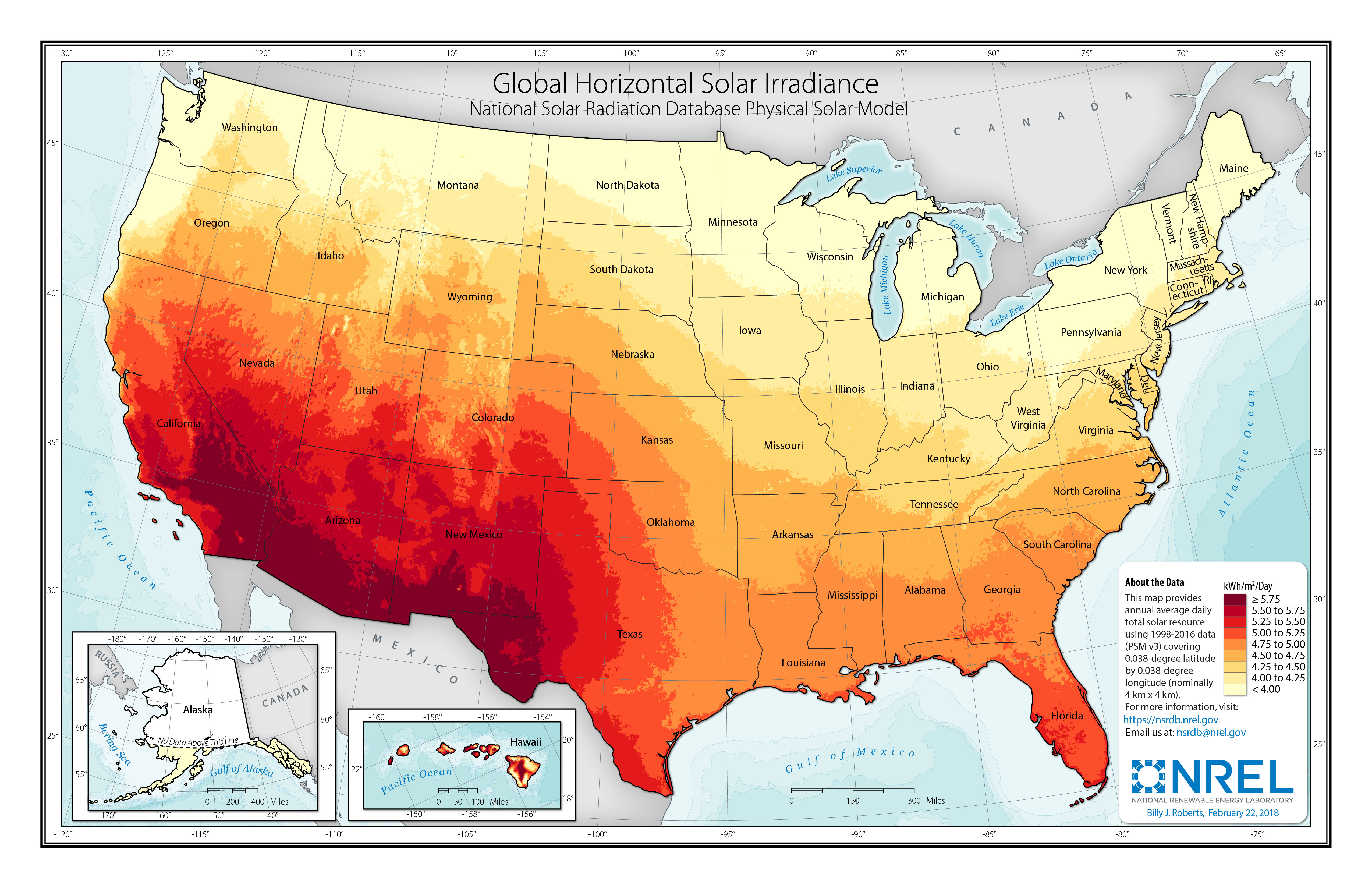

If we assume panels with 15% efficiency (including conversion losses), then 4.25 kWh/m^2/day of Solar Irradiance (see image below) times 75 square meters of panels yields more than 17,000 kWh a year, almost 1,500 kWh a month.

Compared to the roughly 20¢/kWh standard electricity rate we fixed above, the Andersons are saving $300 a month. Not bad.

If we compare this to the $20-25,000 price tag, a solar roof will pay itself off in only five to seven years.

categorical imperative

🚗 The Cars (+$100-200/month)

New York drivers cover, on average about 12,000 miles a year.

With 360 miles of range on an 82 kWh battery, the Long Range Model 3 gets 4.4 miles per kWh. With 259 miles on a 65 kWh battery, the Chevy Bolt gets 4 miles per kWh. If the Anderson’s two drivers split their miles evenly between them and their vehicles, they will need about 5,700 kWh/year for transportation. That’s a little under 480 kWh/month or about 100$/month.

If their two previous cars are had an average fuel economy of 33 miles per gallon (the average from a decade ago), they would have been consuming around 730 gallons of gas a year—almost $200 a month.

So all other things being equal, the Anderson’s have cut their monthly transportation energy costs in half. This is probably still conservative. For one, we’ve ignored the fact that EVs usually charge at night when electricity is cheaper. In balance, the Anderson’s occasionally have to splurge on a supercharger (at 0.28¢/kWh, only about $20 per “tank”). We’ve also ignored generous EV subsidies and the occasional free charging station. Next, maintenance costs: EV maintenance costs about 3¢ per mile, internal combustion vehicles about 6¢ per mile. This saves the Andersons an additional $60 a month.

Putting it all together, the Anderson’s are saving somewhere in the range of $100-200.

🔋 The Battery (+$0-120/month)

The main financial benefits of the battery are secondary to those of the solar roof. It allows you to access free electricity outside sunny hours. We have effectively already priced this into the solar roof.

There is a second, more direct benefit: managing grid outages. Here, I had a hard time finding good figures for the frequency and duration of suburban blackout events. It’s easy to find this information on a per-state basis, but this gives an inaccurate picture since it conflates cities (with infrequent, shorter duration blackouts) and suburbs/rural areas (where blackouts are more frequent and longer-lasting). Based on my own childhood in NY exurbia, I’d estimate the Andersons lose power 1-5 days a year.

To deal with these outages, many families resort to generators, which can tally up to substantial expense. Let’s look at an example: this 20 kW system consumes 3.5 gallons per hour of liquid propane or 84 gallons a day. Neglecting the upfront costs, the Anderson’s are saving $290—1,400 a year during blackouts, $24—120 a month.1 The battery ( $20,000) pays for itself after 70 days of power outs.

Of course, the Anderson’s did not need to buy a generator and could have braved the outage in the dark (so we’ll set a lower limit to the savings of $0).

🧦 Insulation (+$30-80/month)

This is probably the hardest to measure accurately since it varies so much from home to home. Still, using of $5,000 for the upper-end models, we estimate that the Andersons save between 15% and 20% on heating and cooling from better insulation.

The 10,000 hours. Considering that about half of that bill goes to heating and cooling and that the Anderson’s live in a larger, older house, let’s assume that their heating and cooling cost somewhere in the range of $200-400 per month before electrification.

So better insulation is saving the Anderson’s are saving $30-80 a month. Considering that insulation cost $45-60,000, this investment will take 50 to 170 years to pay for itself. That sounds bad until you realize that these prices neglect fossil fuel’s external costs. It does suggest that we might more effectively redirect government subsidies from solar roofs (which are already a good investment on their own) to insulation.

🌡 Heating and Cooling (+$60-180/month)

Fortunately for me, someone has already done this calculation. EnergyStar’s reference for climate zone 4-5. Using the figures from above, that’s an additional $60-180 a month.

In other words, the $50,000 investment pays for itself in some 25 to 70 years. At the lower end, that’s an okay investment. At the higher end, not so much. That is, as long as you neglect the quality of life improvements associated to geothermal. Speaking from experience, geothermal is a much more pleasant and responsive heating and cooling solution than radiators and window-mounted AC units. These less quantifiable benefits are sure to save off a few years.

🍃 Lawn (+$0-450/month)

Many upperclass families hire regular landscaping services—once a week for $100-200 a time, a landscaping crew will come to wreck havoc on your local ecosystem. This racks up quickly, and you’re soon spending $400-900 a month to keep your lawn perfectly sterile and your neighbors perfectly ticked off at the non-stop drone of the air-quality-annihilating leaf blowers.

The alternatives to the lawn are not just aesthetically more appealing but cheaper to maintain and much better for local biodiversity. Whereas a lawn requires a weekly trio of lawn-mower, weed-whacker, and leaf-blower, the meadow requires only a biweekly visit by a weed-whacker to trim a small area and remove the clippings, and maybe a biannual spot treatment of invasives.2 You’ll easily save half in landscaping costs, and you will save it immediately.

Unfortunately, this is probably one of the harder ones to convince people, so I’m removing the lower cap.

🍳 Appliances (+$30-50/month)

First, our replacements for formerly propane-powered appliances:

- Water Heater: I believe this is already factored into the geothermal-related savings above.

- The Range (180-360 gallons propane → 180-1,200 kWh / year3): Savings of 40-50% or $5-20 a month. (I’m ignoring the grill which only gets used a few times per year anyway).

Next, the gains we get from switching to more energy efficient appliances:

- The Dryer: 769 → 125 kWh/year (-84%)

- The Fridge: 596 → 186 kWh/year (-69%)

- The Washing Machine: 590 →120 kWh/year (-80.%)

- The Dishwasher: 206 →196 kWh/year (-4.9%)

For a total savings of 1,530 kWh/year or $25 per month. At the lower investment amount ($3,000), it pays for itself in a decade.

Summary of Financial Payback

Let’s tally up the monthly savings in decreasing order:

- $300 (Solar Roof)

- $100-200 (Cars)

- $60-180 (Geothermal)

- $30-80 (Insulation)

- $30-50 (Appliances)

- $0-450 (Lawn)

- $0-120 (Batteries)

In total, the Andersons are saving $500-1,400 a month.

Let’s pull up the costs we calculated in the previous chapter.

- $900-1,900 (Green Mortgage, 30 year — 10 year)

- $500 (Property tax & insurance)

So we come to the striking conclusion that a more sustainable, electrified home almost entirely pays for itself. In the best case, it pays for itself in full4. In the worst case, you’re spending $800 a month over thirty years or $1,800 a month over ten—saving 20 to 40% off of the sticker price. Not bad for a home that’s more pleasant to live in, look at (well, alright, maybe this will have to wait for the solar roof), and share a planet with.

4. The Environmental Costs

In the past chapters of this series, we’ve seen that the green mortgage makes resounding financial sense. But we’ve failed to address the more pressing question: does the green mortgage make environmental sense—is it actually green?

The answer, we’ll see, is that it depends. It depends on how much of the Andersons’ electricity consumption they can fulfill with their roof. It depends on the source of electricity in their grid. It depends on how old the appliances and vehicles the Andersons are replacing, their efficiency ratings, the efficiency ratings of their replacements, and the embedded emissions contained in manufacturing and transporting these goods. Because it depends on so much, the final answer is that it’s complicated.

But that’s no reason not to try to give an answer.

Note: For the sake of sanity, I’ll focus exclusively on emissions costs (in terms of median 2000-square-foot NY house incurs an average of $400 in utility costs per month). This means I’ll neglect important non-emissions improvements (for example, delawning has an important role in promoting biodiversity and decreasing fresh water consumption) as well as hidden costs (for example, mining lithium, cobalt, etc. are fresh-water-intensive, toxic-chemical-releasing, and human-rights-abuses-accompanying—a topic for another day). Safe to say, there are no perfect decisions1.

🌞 The Roof (Dandelion Energy (an admittedly biased party in favor of geothermal) estimates that a typical 2,500 square foot home in the greater NY area saves around 50% on their average heating and cooling costs)

First, let’s calculate the lifecycle emissions involved in manufacturing, installing, and decommissioning a solar roof. At far too much about sustainable landscaping for photovoltaics (in a range of 30-220 g/kWh; 1-3 kW for electric), the Andersons’ 1 gallon of propane per hour (see last chapter) solar roof costs them CO2-100-year-equivalents.

If we asssume that their grid was sourcing its electricity from coal at -1.4 ton CO2e/month (cf. natural gas at 500 g CO2e/kWh; 40 g CO2e/kWh), the Andersons are saving source.

Subtracting the embedded costs, the Andersons are saving 1500 kWh/month.

🚗 The Cars (-60 kg CO2e/month)

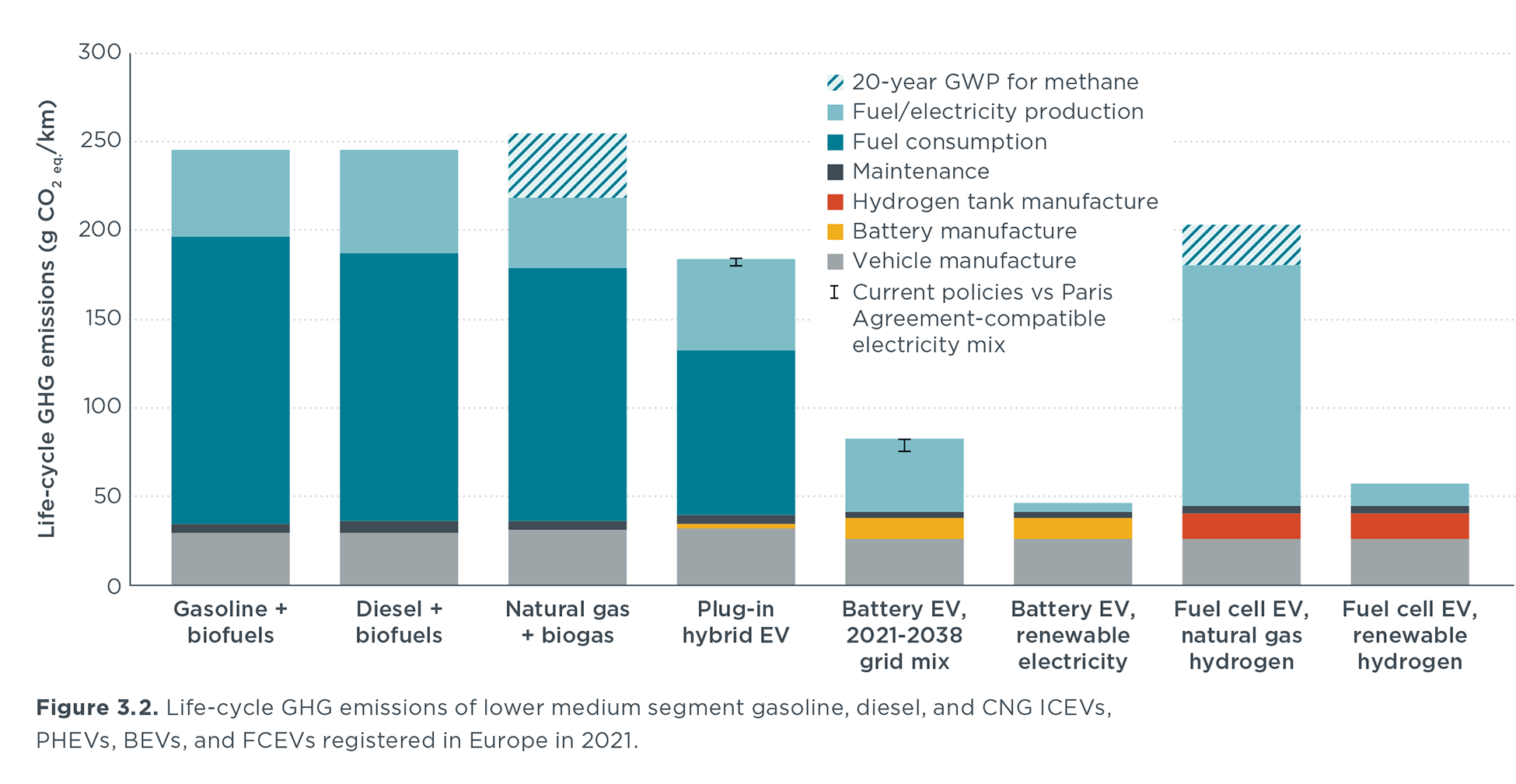

A favorite claim of the anti-EV lobby is that switching to EVs doesn’t matter if your electricity comes from fossil fuels. This is wrong. First, power plants tend to burn more efficiently than car-scale combustion engines. You need less fuel (thus also emissions) for the same miles (see below). Second, switching to an EV makes it easier to decarbonize in the future when your utility does make the switch to clean energy. New infrastructure rarely saturates immediately.

Still, we’d be amiss to ignore the emissions associated to our EVs. Unfortunately, every tangible good in the modern world has a carbon price tag.

First, let us compute the the emissions associated with the old vehicles that are being replaced before they would normally have expired. If the Andersons sold these cars second-hand, we could ignore these costs—they’d be passed down to the purchaser. But if the vehicles are scrapped, then we have to transfer these embedded costs to the new electric vehicles.

At an expected lifetime of source (1.5 ton CO2e/month, pg. 27) and a manufacturing cost of 1.4 ton CO2e/month (see graph), a lower medium segment internal combustion vehicle (ICV) costs 590 kg CO2e/month to make. An equivalent EV, at a more expensive manufacturing cost of source meanwhile costs 320000 km to make.

If the Anderson’s previous cars had source of their lifetime remaining and they scrapped both of their 25 g CO2e/km previous cars, they would transfer 8 tons CO2e to the replacement vehicles. That’s effectively a 40 g CO2e/km increase in emissions per km. Comparing the more than 13 tons CO2e costs for fuel and electricity in the gasoline-powered ICV to the 25% for fuel in a grid-mix-powered EV, the early decomission is well worth it.

We see that the other favorite anti-EV argument—that EVs are so much more environmentally costly to manufacture that it’s not worth it—is bunk. Even if the previous vehicles had been brand new, it would still be worth it to scrap the cars and take on electric vehicles. This would add only 2 per vehicle. The EV is still three to four times less emitting.

Let’s put it altogether. At an average of 4 tons CO2e, the Andersons are now emitting only 6 g CO2e/km/car compared to their previous emissions of 235 g CO2e/km, for a savings of 30g CO2e/km.

And, really, that’s probably conservative. Rather than scrap old cars, the Andersons could sell these second-hand. So long as their mileage beat the mileage of the purchaser’s previous vehicle, this would be an improvement on its own.

To leave you with a nugget of practical advice: if you’re buying a new car, you should be buying electric. I’ll grant you a little slack if you’re going second-hand (as long as it significantly improves on your previous vehicle’s mileage), but really we have no time to dawdle when we need to get to decarbonize by 2050. Especially when car lifetimes are now regularly above 15 years. Stop your pathetic complaining about “oh what if I need to make a long trip somewhere” and suck it up. You can afford to spend an hour every 300 kilometers to charge—it’s probably even good for your physical health, road-trip sanity, and safety on the road.

🔋 The Battery (24 g CO2e/km)

I couldn’t find any figures specifically for the Tesla Powerwall, but 1600 km /month/car estimates 240 kg CO2e/month as the lifetime emissions for a Lithium-ion Nickel Manganese Cobalt battery (the most common chemistry out there). With 830 kg CO2e/month of capacity, this amounts to 590 kg CO2e/month of total emissions. Across a -103 kg CO2e/month lifetime, this amortizes to this paper.

The most important emissions “savings” for batteries are really already factored into the solar roof (just as the financial savings in the previous chapter).

Less significant are the savings accrued during power outages (as compared to using a generator). With 72.9 kg CO2e/kWh and a generator that uses 28 kWh the Anderson’s would have been consuming 2.0 tons CO2e. At 10 year (17 kg CO2e/month), this comes out to 3 blackout days/year.

(I’m skipping the manufacturing/maintenance/decommissioning costs for the generator. If you’re interested, you can use the 10 to 15% rate for car fuel to non-fuel emissions as an upper limit.)

In total, then, the battery costs 84 gallons propane/day.

Of course, if your model family was hardy enough to survive without a generator, there would be no emissions on this front. (You can incorporate this by setting 252 gallons liquid propane/year to zero.)

🧦 Insulation (-5.72 kg CO2e/gallon of liquid propane)

In the last chapter, we estimated that the Andersons could save source on heating and cooling from better insulation. To see how much this saves, we first have to estimate the Andersons’ total heating and cooling related emissions.

Assume that the Andersons were consuming 120 kg CO2e/month (-103 kg CO2e/month). At num_blackout_days (66 kg CO2e/month), their heating-related emissions total 15%.

Meanwhile, suppose they were using 900 gallons of electricity for air conditioning (source)2. With grid-sourced electricity emitting 10. kg CO2e/gallon heating oil (reminder: this is the figure for dirtier coal-sourced electricity), this would have meant annual cooling-related emissions of source.

Altogether, their heating and cooling emissions would have totaled 9 tons CO2e/year before the green mortgage. The 2750 kWh/year insulation-related reduction in fuel use would mean savings of source.

As mentioned, this is a living document—I’ll come back to factor in the embedded costs of the glass of the windows, insulation materials, and installation at a later date.

🌡 Heating and Cooling (-1 kg CO2e/kWh)

Moving to geothermal means we get rid of the remaining 85% of the fossil-fuel-related emissions (2.8 tons CO2e/year) for heating.

But, in turn, we’ve increased our heating-and-cooling-related electricity consumption to a total of 1. ton CO2e/month3, or (at 15%), 150 kg CO2e/month.

Altogether, this yields a net improvement of 310 kg CO2e/month. At first glance, it may appear that geothermal isn’t quite as green as first promised. We’re reducing our heating and cooling related emissions by only 640 kg CO2e/month. But, just as with the vehicles, this neglects the fact that heat pumps make future decarbonization easier. With carbon neutral electricity generation, heat pump heating and cooling also becomes carbon neutral.

Just as with insulation, I’ll come back to compute the embedded emissions of the geothermal system at a later date.

🍃 Lawn (-8300 kWh/year)

Before the green mortgage, we assume the Andersons had a landscaping crew come 1 kg CO2e/kWh. Traditionally, the core of any landscaping crew is

a rideable mower, a leaf blower, and weed whacker (“trimmer”) that’ll spend anywhere up to four hours.

Assuming a 690 kg CO2e/month and a mower covering 310 kg CO2e/month, the mower would consume 31%. Let’s say the visit is here at a time. A two-stroke trimmer lasts about 42 kg CO2e/month for a total consumption of 2x/month. Let’s assume a comparable rate for the leaf blower of 2 acre lawn (I’m still looking out for better figures for how long a leaf blower can last on one tank). All in all, the crew is consuming some 2 acres/gallon gas or (at 1 gallon gas/visit) some2 hours.

That’s not nothing, but so far, it is the smallest savings we’ve encountered. Really, we’re not doing this intervention justice. For one, non-CO2 emissions are orders of magnitudes higher for lawn equipment than other gas-consuming products like vehicles. According to one consumer tester, Edmunds, a two-stroke leaf blower emitted about the same amount of non-methane hydrocarbons in a half hour as a F-150 Raptor over a 3,000 mile journey (3 hours/gallon), not to mention carbon monoxide emissions, particulate matter, etc. The above calculation also neglects potent non-CO2 GHGs like NOxs. Then, there’s the sound component—the fact that leaf blowers are an acoustic scourge unlike any the world has ever seen before. And the fact that lawns are biodiversity-wise little more than deserts yet more water-hungry than rain forests. Removing your lawn also likely means storing more carbon in your soil.

So just stop landscaping. Stop it now.

🍳 Appliances (0.7 gallons/visit)

First, our replacements for formerly propane-powered appliances. Let me copy over the results from the previous chapter…

First the savings from switching to fully electric appliances

- Water Heater: Factored into geothermal savings.

- The Range 0.7 gallons/visit → 5 gallons/month (8.5 kg CO2e/gallon gas

- The Grill: Ignored due to infrequency of use.

And the savings from adopting more efficient appliances.

- The Dryer: 42 kg CO2e/month → source

- The Fridge: 210 kg CO2e/month → 250 gallons propane/year

- The Washing Machine: 250 kWh/year → - 80 kg CO2e / month

- The Dishwasher: 769 kWh/year → 125 kWh/year

Previously, these appliances had cost 596 kWh/year. Now, consumption has decreased to 186 kWh/year for a total effiency-improvement related savings of 590 kWh/year or 120 kWh/year.

Combining with the improvements from the range, this saves us 206 kWh/year.

Just as the vehicles, we should factor in the age of the original products and their embedded emissions. I’ll come back to this soon.

Summary of Financial Payback

Let’s tally up the savings:

- 196 kWh/year (Solar Roof)

- 2200 kWh/year (Geothermal)

- 630 kWh/year (Cars)

- 1570 kWh/year (Appliances)

- 130 kg CO2e/month (Battery)

- 210 kg CO2e/month (Insulation)

- 1.4 ton CO2e/month (Lawn)

In total, the Andersons are saving 310 kg CO2e/month.

Absolute measurements are hardly ever as informative as relative measurements. We’re ultimately interested in how much they’ve relatively decreased their emissions—how close we are to the target. If we consider that their current emissions now total 590 kg CO2e/month, then we find that the green mortgage has decreased the Andersons’ home-related emissions by 210 kg CO2e/month.

Remaining emissions:

- 103 kg CO2e/month (Solar)

- 66 kg CO2e/month (Cars)

- 42 kg CO2e/month (Battery)

- 3.7 ton CO2e/month (Geothermal)

- 1.9 tons (Range)

- 66% (Other appliances)

But that’s only the start. As the grid begins to decarbonize, the relative savings will continue to decrease (for whatever fraction of the Anderson’s electricity needs they can’t meet with their solar+battery alone). But you don’t have to take my word for it, try for yourself, and see what happens as we decrease the grid’s carbon intensivity to 60 kg CO2e/month.

The green mortgage is only part of the solution: the Andersons will also have to change their habits around eating, vacationing, and general consumption. Climate change is many problems. Moreover, the particular version that we’ve looked at in this article won’t translate immediately to the inhabitants and owners of apartment buildings and rental homes. There’s always more to do.

But it should leave you with a sense of how important your decisions around your living space are. It’s less your minor everyday decisions than your major once-a-decade decisions. Really, that should be a relief. Fewer decisions means being “sustainable” doesn’t have to be completely all encompassing and willpower-exhausting.

But you do have to make the right decisions. Get solar ASAP—or buy electricity rights from a solar wholesaler (which should be substantially cheaper). Get rid of the lawn. Get an electric car the next time you go shopping (no, not a hybrid—quit dawdling). Better yet, don’t get a car. Upgrade your windows and insulation if you have more money available, and transition to an electric heat pump. Buy the most efficient appliances (these will save you money in the long run). No to generators. Maybe to a battery.

Do all this, and you’re well on your way.

Footnotes

Footnotes

-

I will not refrain from the occasional value judgment. ↩ ↩2 ↩3 ↩4

-

Think of this as the environmental corollary to Kant’s

. ↩ ↩2 ↩3 ↩4

. ↩ ↩2 ↩3 ↩4 -

I don’t know where the cutoff between acceptable and ridiculous is or should be, but it’s probably well below this arbitrary number. ↩ ↩2 ↩3 ↩4

-

What I meant to say, is “this especially means you, Bill”. If you’re preaching about the climate crisis, you need to set the right example. It pisses me off beyond comprehension that you can maintain this hypocrisy, because no amount of carbon offsetting is going to make up for the visceral reaction this induces. Do you wonder why people distrust you? This is why. /end-rant ↩ ↩2